irs tax levy on bank account

Tax Levy On Bank Account LoginAsk is here to help you access Tax Levy On Bank Account quickly and handle each specific case you encounter. The generally used method that a levy is issued would be to freeze everything in your bank account.

Stressed About An Irs Tax Levy Our Experts Can Handle It

If the IRS places a tax levy on your bank you have 21 days.

. Contact the IRS immediately to resolve your tax liability and request a levy release. It can garnish wages take money in your bank or other financial account seize and sell your. A bank levy allows the IRS to legally seize any money a taxpayer has in any type of bank account.

This is recognized as a bank levy. The IRS can place a levy on your bank account to collect on your debt allowing it to take your funds. There are also additional ways a levy can be.

Get help from a qualified tax. Then they levy up to the full amount of the. If you do not either pay the tax in full.

455 9 votes. The IRS serves a bank. An IRS levy permits the legal seizure of your property to satisfy a tax debt.

Discuss your situation with the IRS agent over the telephone and your payment options. The IRS has the power to file a tax levy on your bank account which grants the agency access to that accounts funds upon filing. An IRS bank account levy is a type of tax levy that is when the IRS seizes money from your bank account to cover your taxes owed.

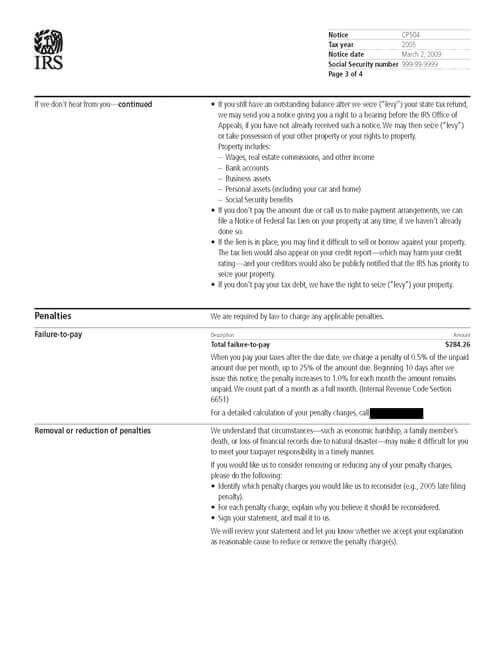

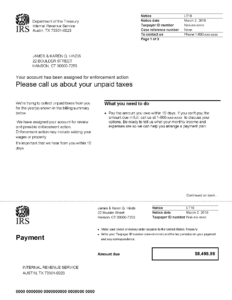

It is different from a lien while a lien makes a claim to your assets as. Removal of IRS Levy. Contact the IRS at the telephone number on the levy or correspondence immediately and explain your financial situation.

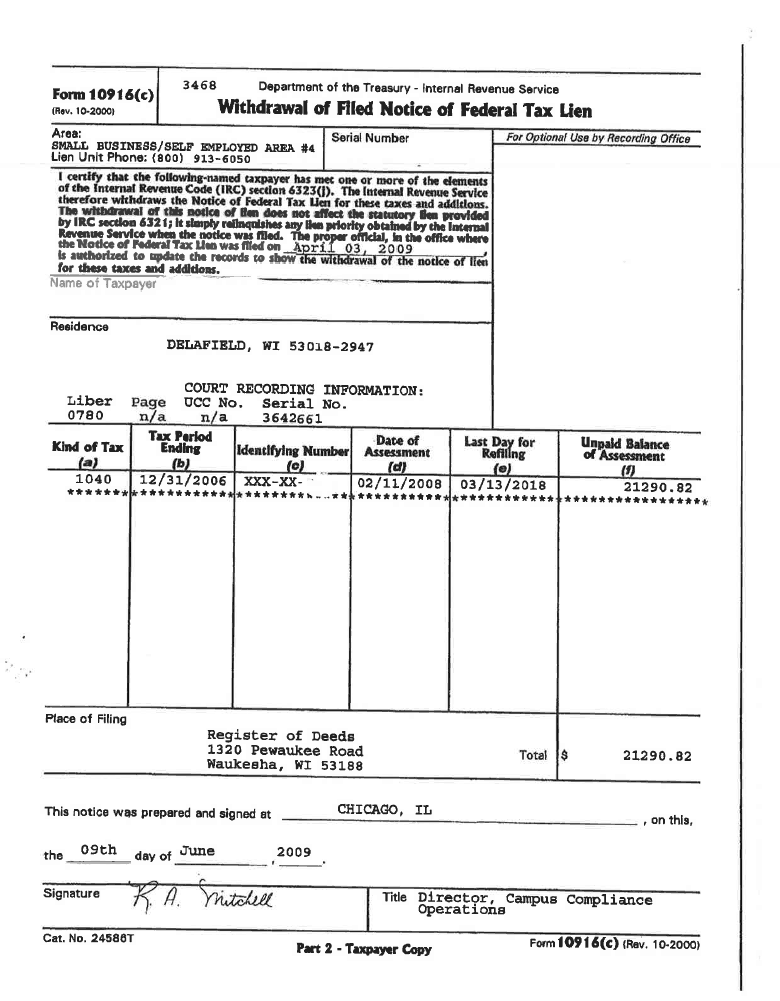

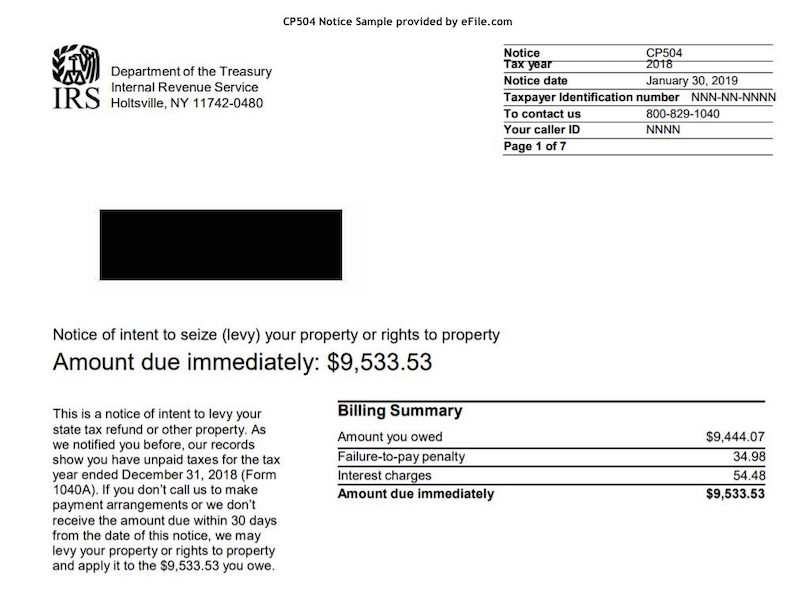

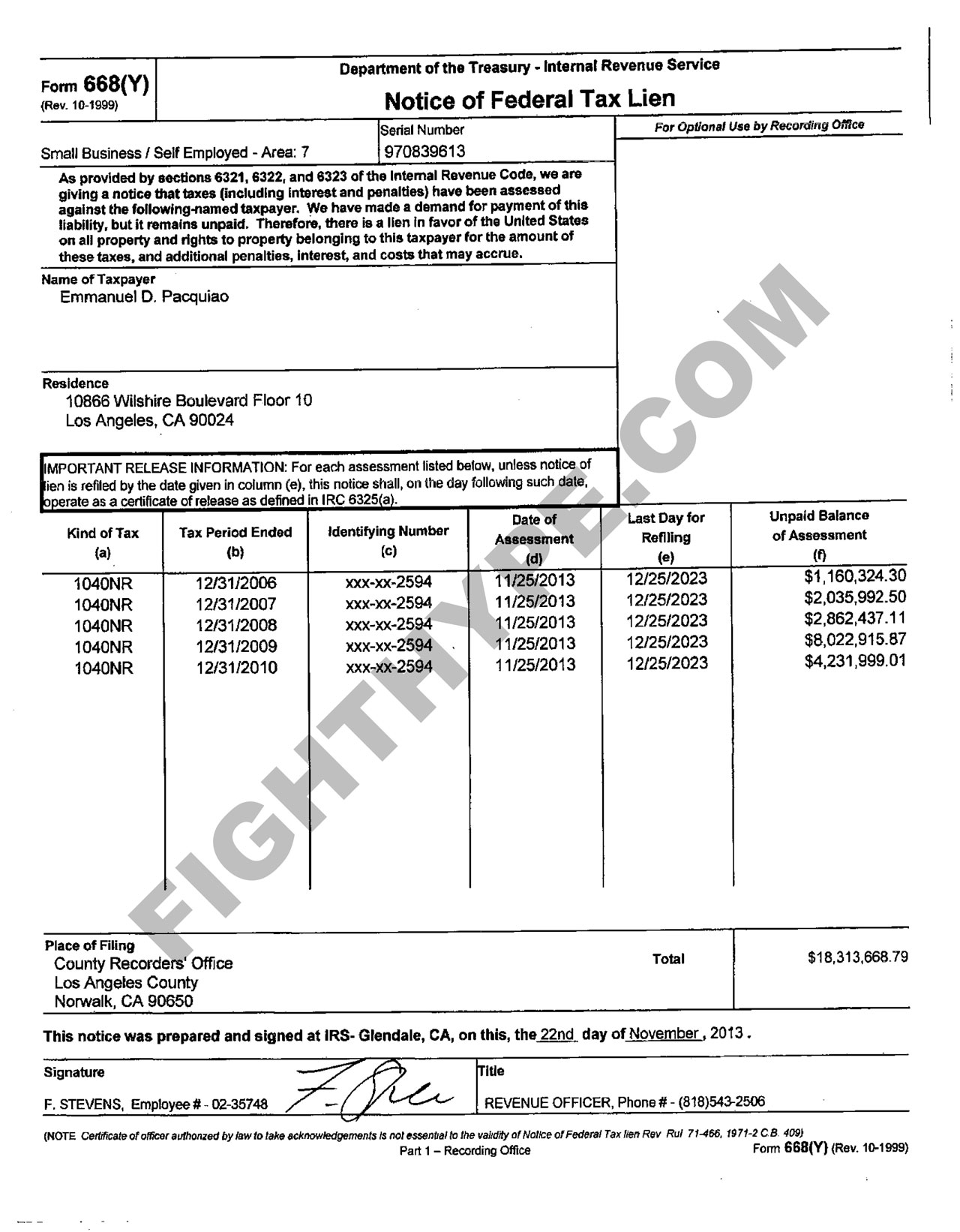

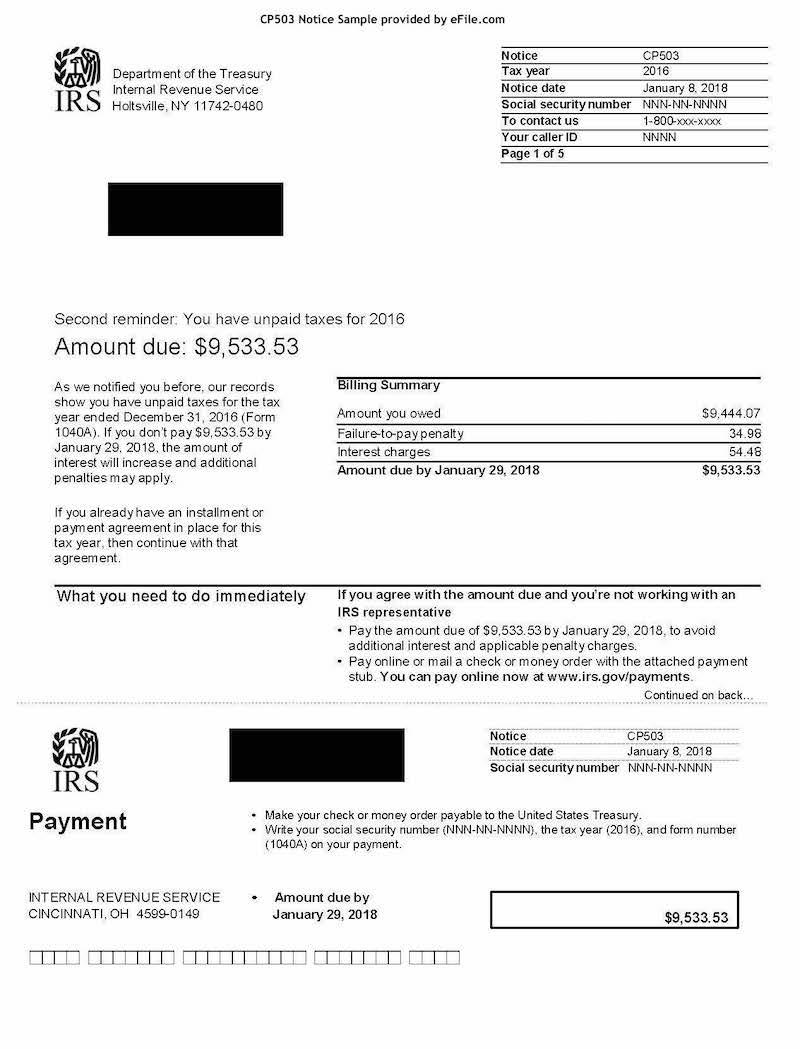

If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets. If you do not either pay the tax in full by the due date stated in the LT11 or call the IRS number on the LT11 before that date to resolve your tax problem the IRS could send an IRS bank levy to. This section discusses how the IRS administratively enforces the tax lien using its power to levy on and sell property of the taxpayer or property encumbered with a federal tax.

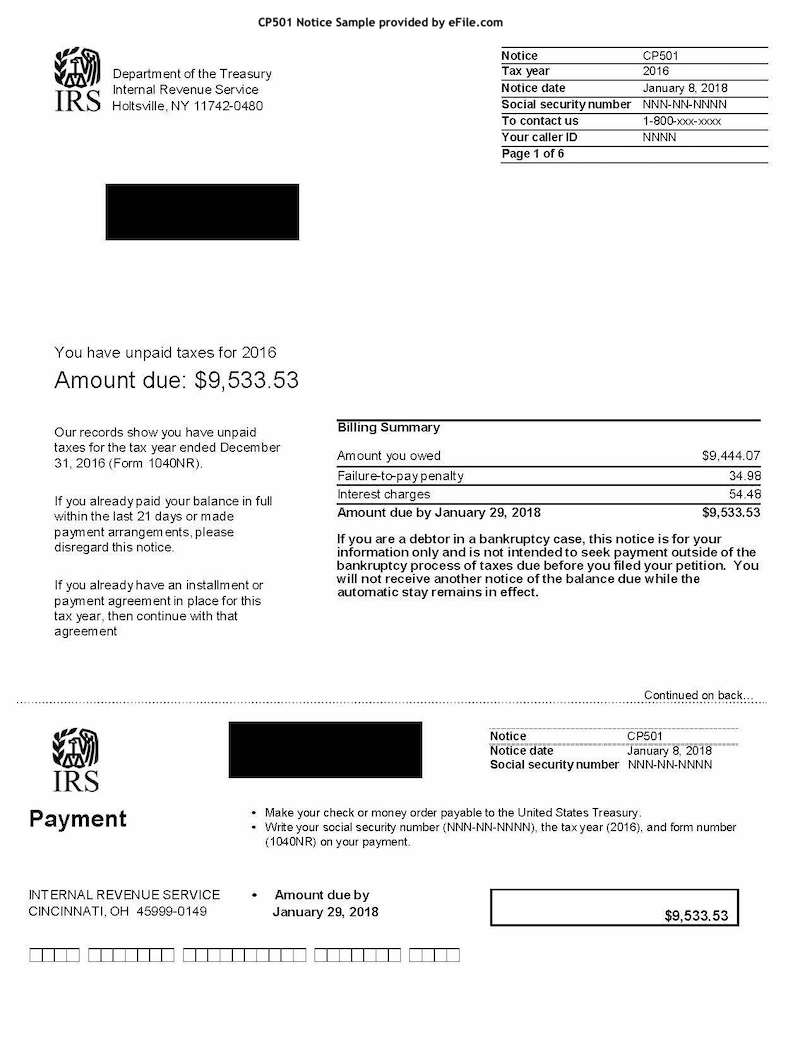

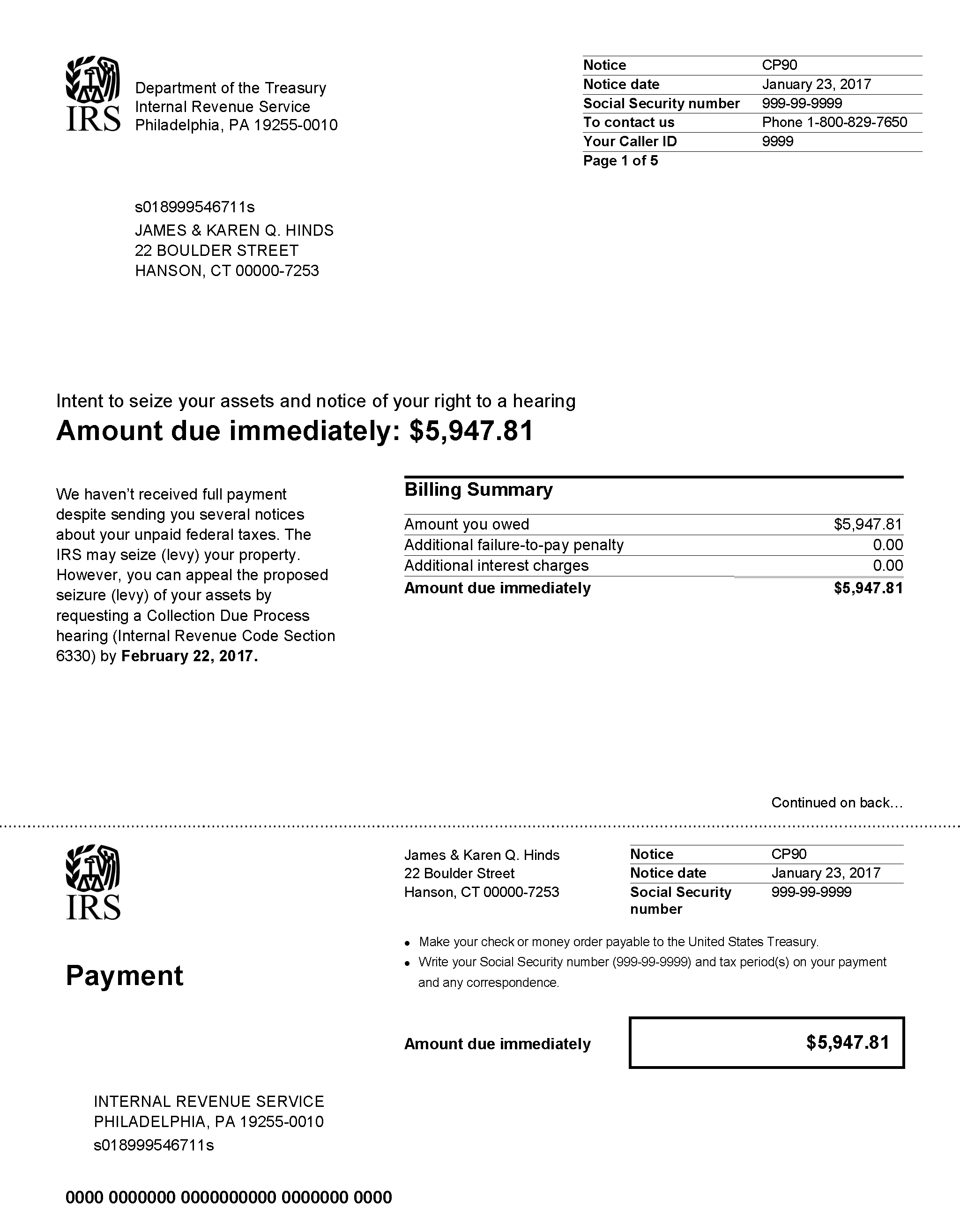

A tax levy is a process that a tax authority uses to forcibly collect tax debts. Call the IRS Collections number on either the LT11 or the CP504. Your initial reaction should be to identify the source of the levy and to make sure that your account is indeed overdue.

Irs Levy On Bank Account will sometimes glitch and take you a long time to try different solutions. A tax levy on a bank account is typically a. If the IRS has sent repeated notices demanding payment.

An IRS bank levy is when the IRS seizes the funds in your bank account to cover your back taxes. It can garnish wages take money in your bank or other financial account seize and sell your vehicle s real estate. Through a tax levy you may have money taken from your bank.

The IRS can also release a levy if it determines that the levy is causing an immediate economic. An IRS levy permits the legal seizure of your property to satisfy a tax debt. How to Resolve a Business Tax.

IRS Levies on Bank Accounts. In the United States the federal tax authority is the Internal Revenue Service IRS. Furthermore you can find the.

The IRS sends levy to the banks that issued you a 1099. The collected amount helps settle outstanding tax owed. If this was a mistake you can also file for lost funds.

If the levy on your wages is creating an. However an IRS levy against your business bank account is a very serious collection tactic and requires serious and immediate action. When the IRS issues a bank levy they are claiming the contents of your bank account to satisfy your.

A tax levy is a process that the IRS and local governments use to collect the tax money that theyre owed. LoginAsk is here to help you access Irs Levy On Bank Account quickly and handle each. Call 877 500-4930 for a free consultation with our team.

They use the 1099 information that is sent from banks that pay you interest. A IRS bank levy is a physical claim on an asset or fixed value of an account.

Are You Being Levied By The State Or The Irs

Irs Took Money From My Bank Account Louisville Bankruptcy Lawyers

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Appealing An Irs Tax Levy When And How To Request

Irs Tax Lien Versus Irs Tax Levy

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Irs 12153 2012 Fill Out Tax Template Online Us Legal Forms

Irs Bank Levy Release Tax Levy Rush Tax Resolution

Irs Levy Get It Removed And Stop Irs Harassment

Irs And State Bank Levy Information Larson Tax Relief

What Does An Irs Tax Levy Mean In Texas

Irs Tax Levy Tax Law Offices Of David W Klasing

Irs Notice Lt16 Your Account Has Been Marked For Enforcement Action H R Block

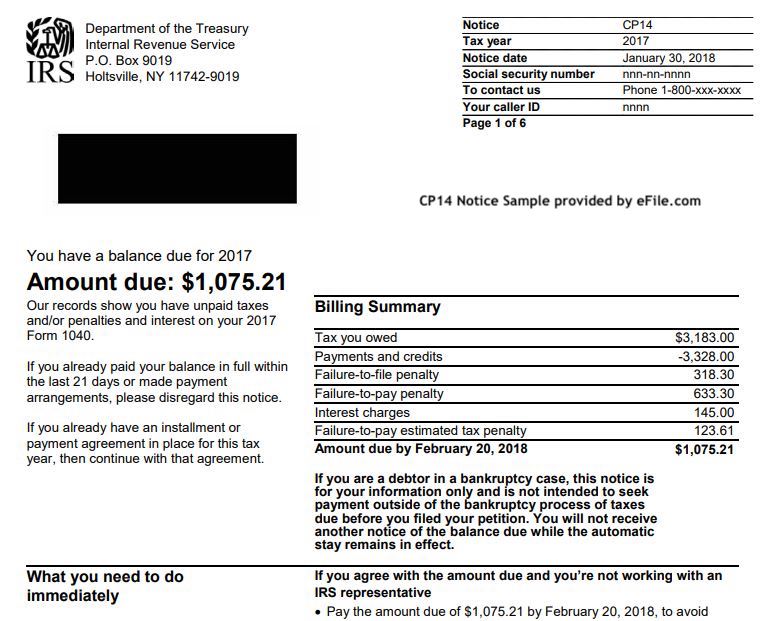

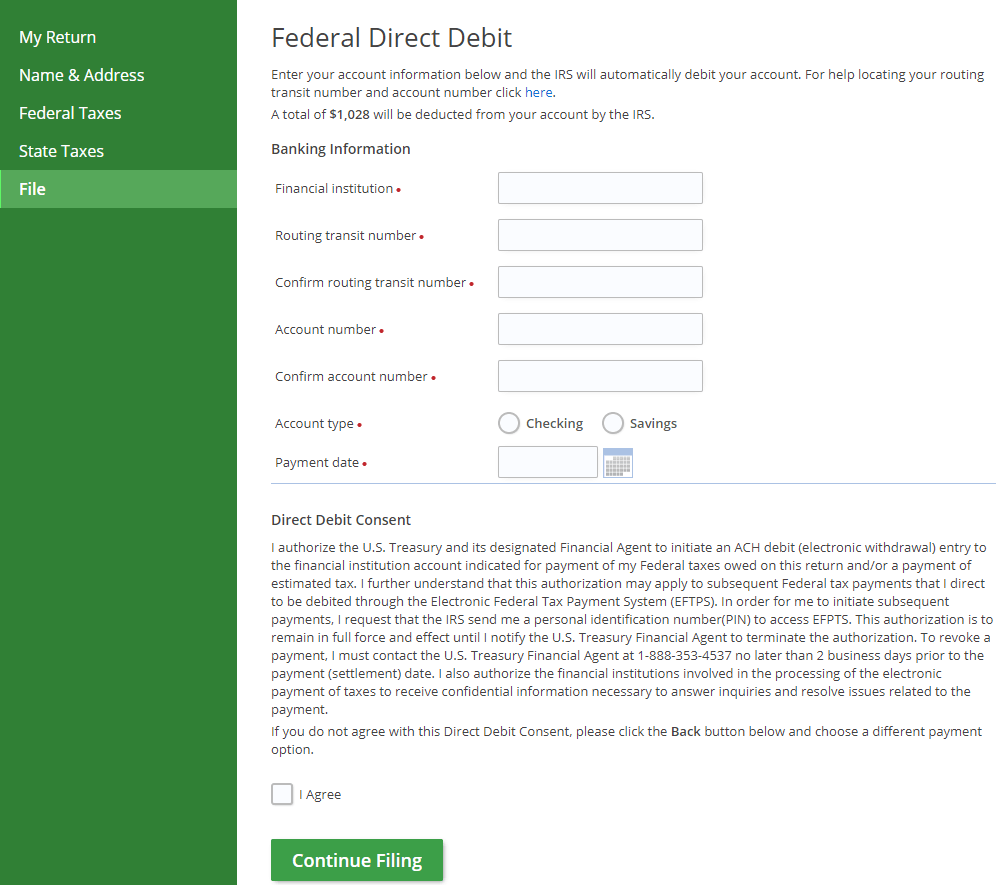

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs And State Bank Levy Information Larson Tax Relief

Irs Levy On Business Bank Account What To Do When Business Levied